The rapid evolution of cryptocurrencies has redefined the landscape of global finance. Amid this financial revolution, XRP—developed by Ripple Labs—holds a unique position, especially in high-adoption markets such as South Korea. For investors and enthusiasts monitoring the “XRP KRW price,” understanding the nuances of Ripple’s exchange rate relative to the Korean Won is critical for informed trading decisions, cross-border transactions, and strategic allocation of digital assets.

The Significance of XRP in the Korean Crypto Market

South Korea stands out as a vibrant hub for digital currency trading, with significant daily volumes on platforms like Bithumb, Upbit, and Coinone. XRP is routinely among the top-traded cryptocurrencies in the region, sometimes even rivaling Bitcoin and Ethereum in terms of local trading volume.

There are several factors behind this strong presence:

- Speed and Cost Efficiency: XRP’s consensus protocol enables near-instant transactions with minimal fees, appealing to Korean users who value swift settlements.

- Cross-Border Remittances: South Korea’s expatriate and business communities frequently require efficient international money transfers; XRP’s integration with financial institutions supports these needs.

- Regulatory Climate: Despite South Korean regulators’ cautious approach to crypto, XRP’s utility as a bridge currency has allowed it to maintain legitimacy among major exchanges.

Real-World Example: Korean Exchange Volumes

A glance at 24-hour trading data often reveals that the XRP/KRW trading pair constitutes a significant percentage of total digital asset trading volume on leading Korean exchanges. This local demand both influences and reflects the fluctuating exchange rate between Ripple and the Won.

What Drives the XRP to KRW Exchange Rate?

The XRP KRW price, like other crypto-to-fiat exchange rates, is determined by a mixture of global and domestic forces. Understanding these factors is essential for both short-term traders and long-term investors.

Key Influencers

- Global XRP Price Movements: Since XRP is traded on hundreds of exchanges worldwide, its price in KRW is inevitably influenced by global pricing patterns against USD, JPY, and other paired currencies.

- KRW Exchange Liquidity: High liquidity in the XRP/KRW market contributes to tighter spreads and more stable prices, but can amplify shifts during high-volatility periods.

- Regulatory Developments: Announcements or legal actions—such as those emanating from Korean regulators or the ongoing SEC case involving Ripple—often cause sharp swings.

- Market Sentiment: News, partnerships, or speculation around Ripple’s technology (for example, adoption by banks) can boost or depress demand in the Korean market.

“The Korean crypto market operates with a unique mix of enthusiasm and rapid reaction to global trends, often resulting in price premiums or discounts for assets like XRP,” says a Seoul-based exchange executive.

Intraday Fluctuations and Arbitrage

Notably, XRP’s KRW price can sometimes exhibit a “kimchi premium”—where the asset trades at a higher price on Korean exchanges compared to international markets. This is often due to capital controls, sudden surges in domestic demand, or delays in arbitrage trading.

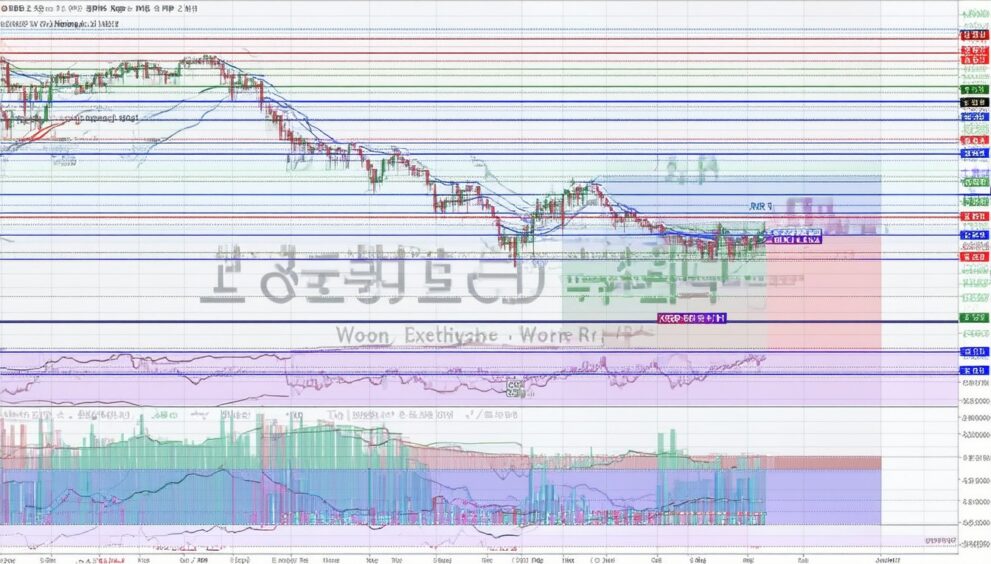

Reading and Using Live XRP/KRW Charts

Live price charts are indispensable for understanding price direction, volatility, and key support/resistance levels. Most platforms provide advanced charting tools, delivering:

- Real-time bidding and ask data

- Historical price movement (candlestick, line, and OHLC charts)

- Volume analysis

- Technical indicators (Moving Averages, RSI, MACD)

Chart Navigation Example

A trader can quickly identify a breakout or a retracement by overlaying 20-day and 50-day moving averages. If the current XRP/KRW rate crosses above both, it may indicate bullish momentum, especially if accompanied by rising volume.

Macro Factors Shaping the XRP KRW Price

Beyond day-to-day price action, macroeconomic trends and policy decisions play a major role.

South Korean Economic Environment

The Korean Won is itself subject to volatility driven by geopolitical risks, trade balances, and policy shifts by the Bank of Korea. When the KRW weakens, XRP’s price in Won can appear artificially inflated even if dollar-denominated XRP prices remain flat.

Crypto Regulatory Updates

South Korea routinely updates its stance on virtual assets. For example, new rules for travel rule compliance and stricter anti-money laundering regulations can impact liquidity and investor confidence, subtly influencing the XRP KRW rate.

International Ripple Developments

Ripple’s ongoing efforts in legal settlements (like the SEC lawsuit in the USA) or advancement in banking partnerships frequently have spillover effects in the Korean market. When Ripple announces a new institutional partnership, Korean investors may react strongly, driving price changes relative to the Won.

Strategies for Monitoring and Trading XRP/KRW

For those seeking to capitalize on or hedge against XRP/KRW price movements, consider the following practical approaches:

1. Use Multiple Sources for Price Discovery

Don’t rely solely on a single exchange. Compare rates on Bithumb, Upbit, or Coinone to get a sense of possible price discrepancies.

2. Automate Alerts and Analytics

Utilize trading bots or mobile apps to set real-time price alerts, track support/resistance levels, and monitor for market-moving news.

3. Pay Attention to KRW/USD Exchange Rate

Since the core value of XRP is often denoted in USD worldwide, abrupt shifts in the KRW/USD exchange rate can affect local XRP/KRW pricing.

4. Keep Abreast of Regulatory News

Monitor official statements from the Financial Services Commission (FSC) and Korea Financial Intelligence Unit (KFIU). Regulatory shocks can trigger both panic selling and rapid recoveries.

Concluding Insights

The XRP KRW price encapsulates more than just a number on a screen—it reflects a complex interaction of local demand, international market trends, regulatory posture, and technological innovation. For Korean investors and global observers alike, understanding these underlying mechanisms is fundamental to making well-informed decisions.

“In fast-moving markets like Korea, being informed is half the battle; timely action is the other half for success with assets like XRP,” notes a veteran digital asset analyst.

By integrating robust chart analysis, monitoring both domestic and international news, and maintaining a disciplined approach, participants can better navigate the volatility and opportunities inherent in the live Ripple to Korean Won market.

FAQs

What is the XRP KRW price?

The XRP KRW price is the current exchange rate of Ripple (XRP) expressed in South Korean Won (KRW). This value fluctuates throughout the day based on trading activity, market sentiment, and broader economic factors.

Why is XRP so popular in South Korea?

XRP’s popularity is driven by its fast transaction speeds and low fees, appealing to Korean cryptocurrency users who value efficient payments. Additionally, robust local trading infrastructure and frequent cross-border remittance needs contribute to strong demand.

How can I track live XRP to KRW prices?

Live XRP KRW prices can be monitored on major South Korean exchanges such as Bithumb, Upbit, and Coinone. Many financial websites and apps also offer real-time price tracking, charting tools, and news alerts.

What causes the “kimchi premium” on XRP in Korea?

The “kimchi premium” refers to XRP (and other crypto assets) trading at higher prices in Korea compared to global markets. Causes include local demand surges, capital controls, and slower arbitrage due to regulatory complexity.

Are there risks in trading XRP/KRW?

Trading XRP/KRW can involve significant risks due to price volatility, regulatory changes, and sudden shifts in market sentiment. It is advisable to stay updated on both local regulations and international developments affecting Ripple and the broader crypto market.

How is the XRP KRW rate different from the USD rate?

The XRP KRW rate reflects not just global market valuations but also domestic factors like the strength of the Korean Won and local trading demand. Sometimes, prices in KRW deviate from the USD benchmark due to market inefficiencies or regulatory conditions.