Cryptocurrency markets have experienced soaring popularity, spurred by innovation and global adoption. Amid this dynamic landscape, ZBCN—standing for ZBC Network—has emerged as a project attracting attention. Tracking the ZBCN price, analyzing its live chart performance, and understanding market data are crucial for traders, investors, and anyone aiming to gauge its role in the digital asset ecosystem.

The Basics: Navigating ZBCN and Its Place in the Crypto Market

What is ZBCN?

ZBCN is the native digital asset fueling the ZBC Network, a blockchain ecosystem designed for scalability and secure transactions. While detailed information about every emerging token varies, ZBCN follows the industry’s standard traits: decentralized issuance, programmable utility, and transparent circulation. Like many crypto tokens, it typically operates on a prominent blockchain, utilizing smart contracts for governance and token management.

Position Among Other Cryptocurrencies

ZBCN exists within a crowded and competitive market. Platforms like Binance, Coinbase, and CoinGecko monitor and compare thousands of tokens daily, each vying for user attention. ZBCN’s market performance hinges not only on its utility and technology but also on macro trends influenced by Bitcoin, Ethereum, and sector-wide sentiment.

“No cryptocurrency exists in a vacuum—each asset’s price sensitivity derives as much from its internal fundamentals as from currents in the wider digital asset marketplace.”

— Crypto Markets Analyst, 2024

Key Metrics: How ZBCN Price Is Determined

Market Capitalization and Circulating Supply

The price of ZBCN is a product of classic supply and demand economics, overlaid with blockchain-specific nuances. Market capitalization, defined as the circulating supply multiplied by the latest price, is a core metric that situates ZBCN among its peers.

- Market Cap: This figure indicates ZBCN’s footprint relative to giants like Bitcoin or newer, niche tokens.

- Circulating Supply: Periodic releases, incentives, or burns can shift supply, directly affecting price.

For instance, a sudden increase in circulating tokens due to ecosystem rewards may put short-term pressure on ZBCN’s price, while coin burns or lockups could drive scarcity and, potentially, valuation upward.

Trading Volume and Liquidity

Live ZBCN price quotes derive from real-time trading activity across multiple exchanges. Volume indicates the depth and confidence in the market—a token with healthy 24-hour trading volume suggests vibrant participation and easier execution of large orders without significant slippage.

Liquidity, measured by the ability to buy or sell ZBCN near the quoted price, further shapes market stability. Thinly traded tokens may experience dramatic swings, which seasoned traders monitor closely using both on-chain data and traditional order book metrics.

External Drivers: Adoption, News, and Regulation

Beyond raw metrics, ZBCN’s price responds to news cycles and regulatory shifts. Announcements of partnerships, technical upgrades, or exchange listings often trigger price volatility. Conversely, adverse regulatory decisions can depress sentiment and market activity.

Recent examples across the sector—such as surges following integration with DeFi apps or declines sparked by cybersecurity incidents—highlight how quickly market sentiment moves.

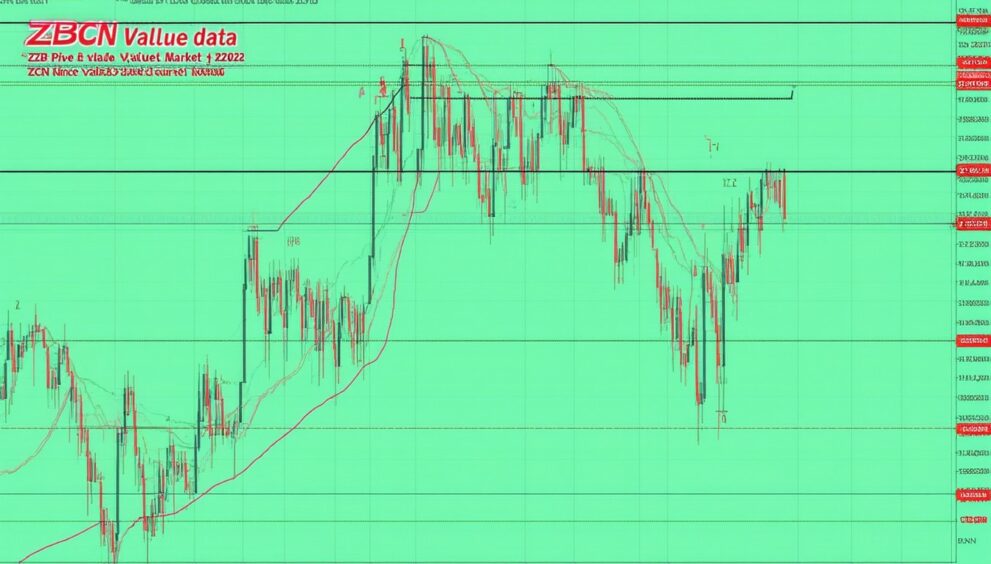

Interpreting ZBCN Price Charts: Strategies for Analysis

Spot Market Price vs. Live Value

The “live” ZBCN value seen on major platforms reflects the most recent transaction. However, prices can vary slightly across exchanges due to regional demand, listing fees, or liquidity.

- Candlestick Charts: Most traders rely on candlestick charts that display open, close, high, and low prices for specific intervals. These charts provide visual cues about market momentum and potential reversal points.

- Volume Bars: Accompanying volume bars offer clues on the strength behind price moves; high volume coupled with price changes typically signals conviction.

Technical Analysis: Identifying Patterns

Technical traders use chart patterns and technical indicators—like moving averages, RSI (Relative Strength Index), and Bollinger Bands—to forecast potential price movements. For ZBCN, trending formations or consolidation phases reveal the balance between bulls and bears.

An example scenario: if ZBCN consistently bounces above a long-term support level on daily charts while trading volume escalates, some analysts interpret this as a presage to a breakout.

Fundamental Analysis: Beyond Charts

While charts and indicators are essential, understanding ZBCN’s roadmap, developer activity, protocol upgrades, and community growth inform a broader perspective. Examining whitepapers, GitHub commits, and ecosystem partnerships helps validate the token’s longevity and value proposition.

Real-Time Market Data: Where to Track ZBCN Price and Value

Leading Platforms for Live Price Feeds

Tracking ZBCN in real time often involves:

- Major Exchanges: Platforms like Binance, KuCoin, and decentralized exchanges (DEXs) provide continuous ticker data for ZBCN pairs.

- Aggregator Sites: CoinMarketCap, CoinGecko, and LiveCoinWatch display consolidated information such as price, volume, market cap, and historical charts.

- Wallet Apps: Some mobile and desktop wallets offer built-in market tracking tools for ZBCN and other assets.

Charting Tools and Alert Systems

Proactive traders and investors often rely on advanced charting software to set alerts for price movements or volatility spikes. These systems help users act on news or technical signals swiftly, a vital edge in fast-moving markets.

Factors That Could Influence The Future ZBCN Price

Project Developments and Roadmap

- Mainnet Launches or Protocol Updates: Significant technical steps can lift investor confidence and price outlook.

- Community Engagement: Active governance and compelling use cases drive organic adoption, potentially supporting price appreciation.

- Strategic Partnerships: Integration with wallets, payment processors, or DeFi protocols tends to have bullish effects.

Macro Environment and Regulatory Changes

- Global Economic Trends: Interest rate shifts, inflation, and macroeconomic instability often catalyze capital flows into or out of digital assets.

- Rules and Compliance: Clarity or crackdowns from major regulators can reshape liquidity and investor interest in tokens like ZBCN.

Risk Factors to Consider

Investing in ZBCN, as with any altcoin, is not without risk. Issues such as smart contract bugs, sudden dilution, or exchange delistings may adversely affect price. Seasoned investors use diversified strategies and risk management tools to navigate these uncertainties.

Concluding Thoughts: Navigating ZBCN’s Dynamic Value Landscape

Constantly evolving, the ZBCN price reflects a blend of internal innovation, market mechanics, and sector-wide sentiment. Understanding metrics like market cap, supply changes, technical patterns, and ecosystem fundamentals is vital for evaluating opportunities and risks.

For market participants, the ability to interpret live ZBCN charts alongside qualitative factors remains crucial. As the broader digital asset sector matures, ZBCN’s journey will depend on its adaptability, technological progress, and community strength.

Staying updated on real-time prices, news developments, and emerging market trends can empower more informed decision-making whether trading, investing, or simply observing this ambitious digital asset.

FAQs

How can I check the live ZBCN price?

Leading exchanges and cryptocurrency data aggregators such as CoinGecko and CoinMarketCap display real-time ZBCN price information, often including detailed historical charts and trading volumes.

What factors influence ZBCN’s price movements the most?

ZBCN price is influenced by supply and demand, market sentiment, technological updates, partnership announcements, and broader macroeconomic forces affecting the crypto sector.

Where can I find historical ZBCN price charts?

Historical price charts for ZBCN are accessible on major crypto tracking sites and some wallet apps, allowing users to analyze past trends and structure their trading strategies.

Is ZBCN a good investment?

Like all cryptocurrencies, ZBCN carries both opportunity and risk. Factors like project fundamentals, utility, community activity, and market volatility should be carefully evaluated before making investment decisions.

Why do ZBCN prices differ between exchanges?

Minor price discrepancies occur due to differences in liquidity, trading volume, and the speed at which each platform updates their prices or executes trades. Arbitrage traders often act to even out these gaps.

What tools help monitor ZBCN price trends?

Charting software, price alerts, and portfolio trackers can help active traders and investors monitor ZBCN’s value and respond swiftly to market changes.